Annotation

- Introduction

- Understanding Check-Cap's Business Model

- Financial Health Assessment

- Strategic Shifts and M Body AI Merger

- AI Investment Landscape Context

- Investment Risk Assessment

- Pros and Cons

- Conclusion

- Frequently Asked Questions

Check-Cap Investment Analysis: High-Risk AI Stock Opportunity Review

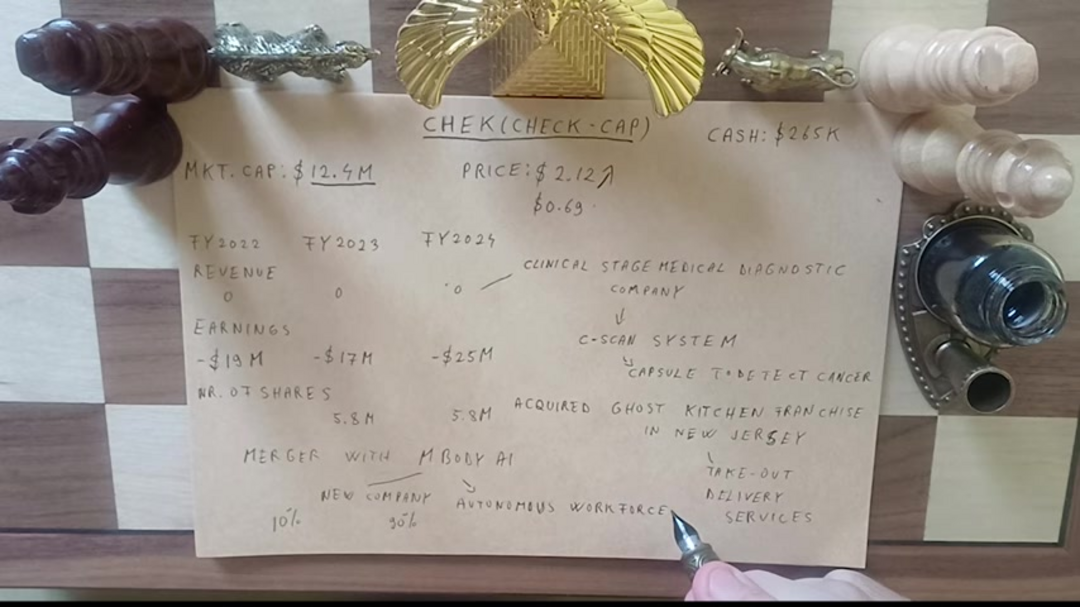

Analysis of Check-Cap (CHEK) stock, covering the M Body AI merger, financial risks, and investment viability in the AI and medical technology sectors.

Introduction

Check-Cap (CHEK) is a complex investment opportunity, an Israeli medical diagnostics firm that gained attention with its M Body AI merger. However, with zero revenue, high losses, and strategic uncertainties, this analysis evaluates if CHEK is a viable investment or just AI hype.

Understanding Check-Cap's Business Model

Check-Cap operates as a clinical-stage medical diagnostic company primarily focused on developing the C-Scan system – an innovative ingestible capsule designed for non-invasive colon cancer screening. The technology represents a potentially revolutionary approach to cancer detection, but it remains in development stages without regulatory approval or commercial deployment. For investors interested in emerging medical technologies, understanding the development timeline and regulatory hurdles is crucial when evaluating companies like Check-Cap.

The company's transition from pure medical diagnostics to broader technology applications through the M Body AI merger represents a significant strategic pivot. This shift reflects the challenges many early-stage medical device companies face when seeking sustainable revenue streams while their core products undergo lengthy development and approval processes. Investors should consider using specialized financial analysis tools to properly assess companies operating in this high-risk, high-reward space.

Financial Health Assessment

Check-Cap's financial picture presents multiple concerning indicators that warrant careful consideration. The company has reported zero revenue for three consecutive fiscal years (2022-2024), with projected losses exceeding $60 million during this period. This revenue drought creates complete dependency on external funding, making the company vulnerable to market conditions and investor sentiment shifts.

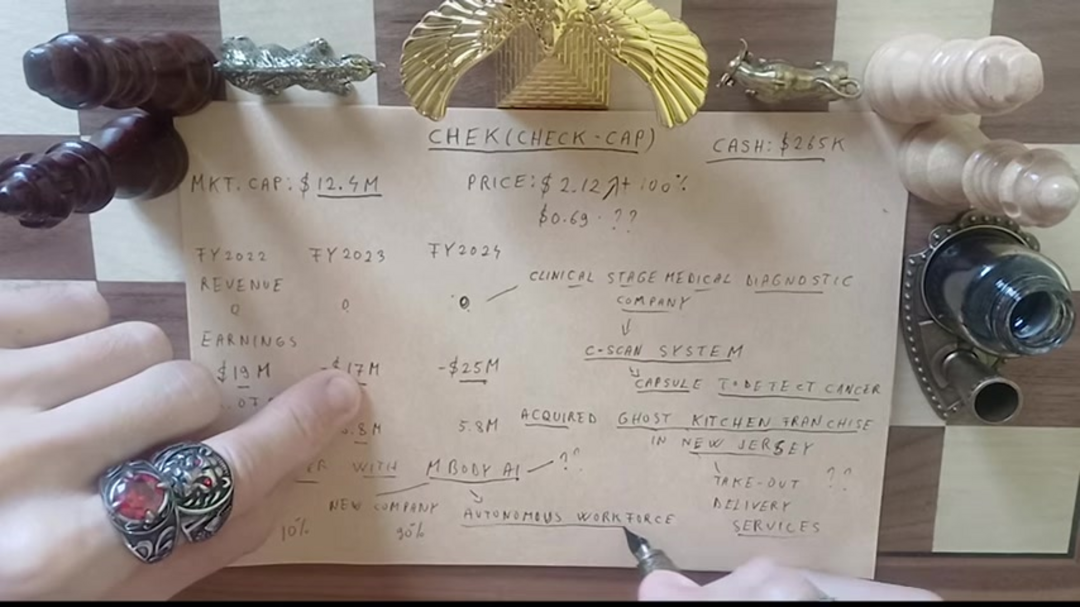

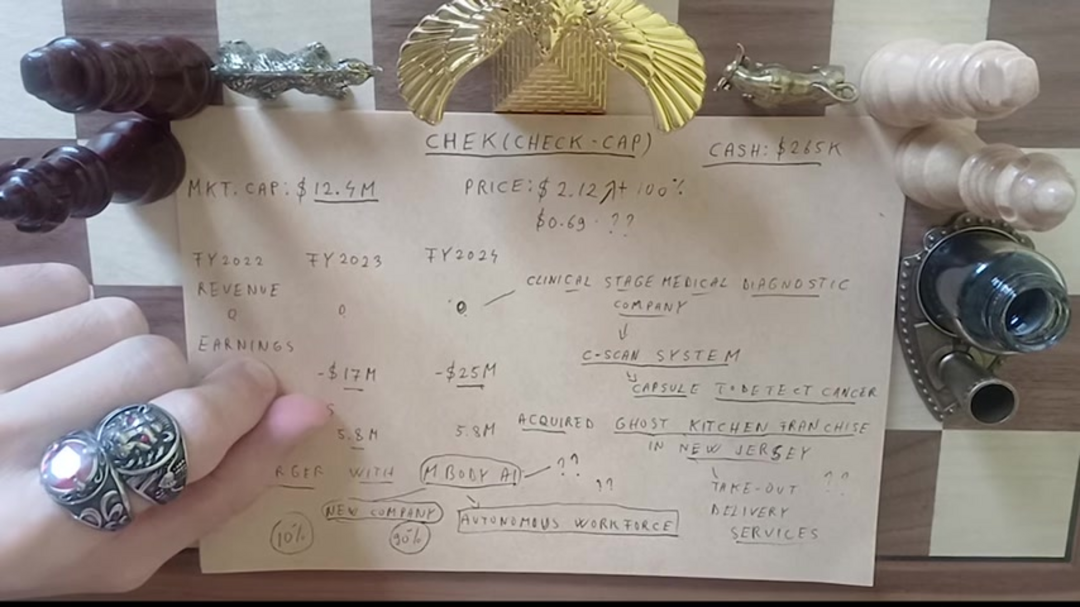

With a market capitalization of approximately $12.4 million and cash reserves of only $265,000, Check-Cap faces significant liquidity challenges. The company's losses substantially exceed its current market value, creating a fundamental disconnect between operational costs and company valuation. This financial profile places Check-Cap firmly in the micro-cap stock category, known for extreme volatility and higher risk profiles compared to established companies.

Strategic Shifts and M Body AI Merger

The announced merger with M Body AI represents the most significant recent development for Check-Cap, triggering a dramatic stock price surge. However, this transaction introduces substantial uncertainty due to M Body AI's status as a private company with undisclosed financials and operational details. The ownership structure – where M Body AI shareholders will control 90% of the combined entity – effectively dilutes existing Check-Cap investors' positions significantly.

Adding to the strategic complexity, Check-Cap's acquisition of a Ghost Kitchen franchise in New Jersey represents a surprising diversification beyond medical diagnostics. This move into food service delivery, while potentially generating near-term revenue, raises questions about management's strategic focus and ability to execute across fundamentally different business models. Investors might benefit from using market research tools to better understand the competitive landscape in both medical technology and food service sectors.

AI Investment Landscape Context

The artificial intelligence sector has generated tremendous investor enthusiasm, with companies adding "AI" to their names often experiencing immediate valuation boosts. However, this enthusiasm must be tempered with rigorous due diligence. M Body AI's focus on "autonomous workforce" technology aligns with current market trends, but without transparent financials or proven products, investors are essentially betting on potential rather than performance.

The AI investment space includes various approaches, from established AI automation platforms to emerging AI agents and assistants. Check-Cap's pivot toward AI through merger rather than organic development suggests a strategic response to market trends rather than a carefully planned technological evolution. This distinction is crucial for investors evaluating the long-term sustainability of the company's direction.

Investment Risk Assessment

Check-Cap presents multiple layers of investment risk that require careful evaluation. The company operates in the high-risk medical device development sector, where regulatory approvals, clinical trial outcomes, and market adoption present significant hurdles. The additional complexity of merging with an unknown private AI company and diversifying into unrelated business segments compounds these inherent risks.

For investors considering positions in similar high-risk opportunities, utilizing robust portfolio tracking tools becomes essential for proper risk management. The combination of micro-cap volatility, zero revenue, and strategic uncertainty creates a profile that may only be suitable for investors with high risk tolerance and appropriate position sizing strategies.

Pros and Cons

Advantages

- Micro-cap status offers potential for rapid growth if execution succeeds

- AI association may attract speculative capital and short-term gains

- Clinical-stage medical technology addresses significant market need

- Strategic diversification could create multiple revenue streams

- Merger provides access to AI technology and expertise

- Israeli innovation ecosystem supports technology development

- Non-invasive cancer detection represents breakthrough potential

Disadvantages

- Three consecutive years with zero revenue generation

- Substantial financial losses exceeding market capitalization

- Critical lack of information about M Body AI's operations

- Strategic diversification raises focus and execution concerns

- High probability of future shareholder dilution

Conclusion

Check-Cap offers high-risk, high-reward potential but faces financial challenges like zero revenue and cash burn. The AI merger adds uncertainty, making it speculative. Investors should proceed with caution and due diligence.

Frequently Asked Questions

What is Check-Cap's primary business focus?

Check-Cap is an Israeli clinical-stage medical diagnostics company developing the C-Scan system, an ingestible capsule for non-invasive colon cancer screening. The company has recently diversified through a Ghost Kitchen acquisition and merger with M Body AI.

How does the M Body AI merger affect Check-Cap investors?

The merger gives M Body AI shareholders 90% ownership of the combined company, significantly diluting existing Check-Cap investors. Since M Body AI is private with undisclosed financials, this creates substantial uncertainty about the merger's true value.

What are the main financial risks with Check-Cap?

Key risks include three consecutive years of zero revenue, losses exceeding $60 million, minimal cash reserves of $265,000, high probability of future shareholder dilution, and dependence on external funding for operations.

Is Check-Cap a good investment opportunity?

Check-Cap represents a high-risk speculative investment rather than a fundamental opportunity. While the AI merger and medical technology offer potential, the financial challenges and strategic uncertainties make it suitable only for investors with high risk tolerance.

What is the C-Scan system developed by Check-Cap?

The C-Scan system is an ingestible capsule for non-invasive colon cancer screening, currently in clinical development without regulatory approval or commercial deployment.