Rocket Money

Rocket Money is a powerful personal finance app for saving money, managing subscriptions, tracking spending, and negotiating bills. Discover how it compares to Mint and other alternatives for 2024.

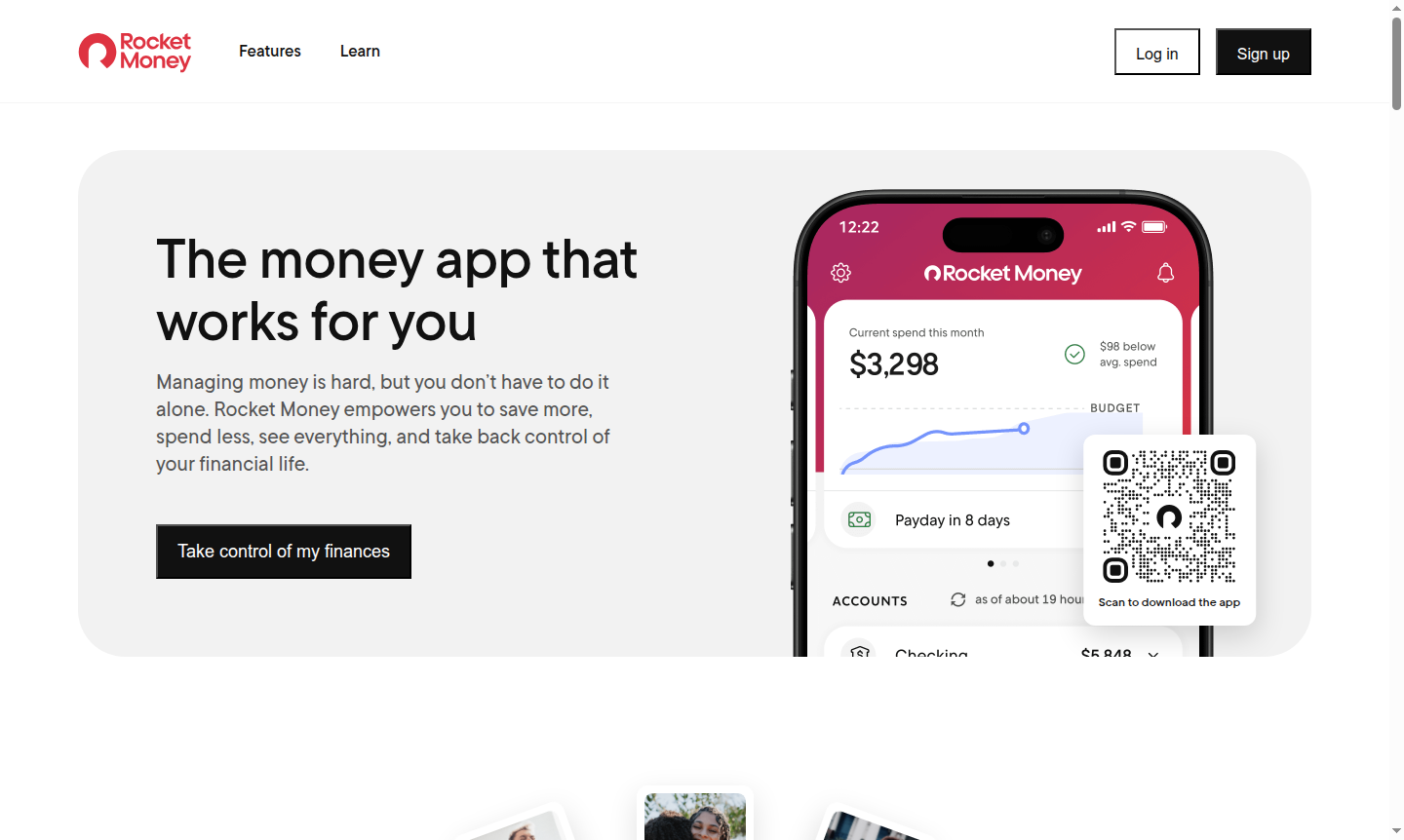

Overview of Rocket Money

Rocket Money (formerly Truebill) serves as your comprehensive financial control center, helping over 10 million members save more, spend less, and regain control of their financial lives. This powerful personal finance app automatically tracks all your accounts – including checking, savings, credit cards, and investments – to provide a clear, unified picture of your income and expenses. By connecting your financial institutions once, Rocket Money handles the ongoing monitoring and analysis, making it easier to understand where your money goes each month and identify opportunities for improvement.

As a leading solution in Home Budgeting and Home Automation, Rocket Money has helped members save over $2.5 billion by identifying unnecessary subscriptions, negotiating better rates on existing bills, and providing intelligent spending insights. The platform combines automated financial tracking with human-assisted services through its Premium offering, creating a hybrid approach for optimal financial health.

How to Use Rocket Money

Getting started with Rocket Money is straightforward – simply download the app from the Apple App Store or Google Play Store and create your account. The setup process involves securely linking your financial accounts through encrypted connections. Once connected, Rocket Money automatically analyzes your financial patterns, identifies recurring subscriptions, tracks bill due dates, and categorizes your spending, providing personalized recommendations via its intuitive dashboard.

Core Features of Rocket Money

- Subscription Management – Automatically finds and tracks all recurring subscriptions with cancellation assistance

- Bill Negotiation Services – Professional concierge negotiates lower rates on your existing bills

- Automated Savings Plan – Intelligent algorithm saves money automatically based on your spending patterns

- Spending Tracking – Comprehensive breakdown of expenses across all linked accounts

- Credit Score Monitoring – Free credit report access with alerts for important changes

Use Cases for Rocket Money

- Individuals wanting to track and cancel unused subscriptions automatically

- Families needing comprehensive budgeting and expense tracking

- People seeking professional bill negotiation to lower expenses

- Users transitioning from Mint for robust personal finance alternatives

- Anyone wanting automated savings without manual calculations

- Individuals monitoring credit scores and financial health

Support and Contact

For customer support, visit the Rocket Money website or email contact@rocketmoney.com. Comprehensive help resources, documentation, and direct messaging are available for assistance.

Company Info

Rocket Money is developed by Rocket Money, Inc., a financial technology company based in the United States, specializing in innovative personal finance solutions that combine automation and human expertise.

Login and Signup

To access Rocket Money or create a new account, visit the Rocket Money website for web access or download the mobile app from app stores. Free and premium subscription options are available.

Rocket Money FAQ

What is Rocket Money and how does it help with personal finance management?

Rocket Money is a comprehensive personal finance app that automatically tracks all your accounts, manages subscriptions, negotiates bills, and provides spending insights to help you save money and achieve financial goals.

Is Rocket Money free to use or are there subscription costs?

Rocket Money offers both free and premium subscription plans, with the free version providing basic functionality and premium offering additional features like bill negotiation and automated savings.

How does Rocket Money compare to other budgeting apps like Mint?

Rocket Money provides robust subscription management, bill negotiation services, and automated savings features that many users find superior to Mint for comprehensive financial control.

How secure is Rocket Money with my financial data?

Rocket Money uses bank-level encryption and secure connections to protect your financial information, ensuring data privacy and security for all users.

What types of accounts can I link to Rocket Money?

You can link checking, savings, credit cards, loans, and investment accounts to Rocket Money for comprehensive financial tracking and management.

Rocket Money Reviews0 review

Would you recommend Rocket Money? Leave a comment