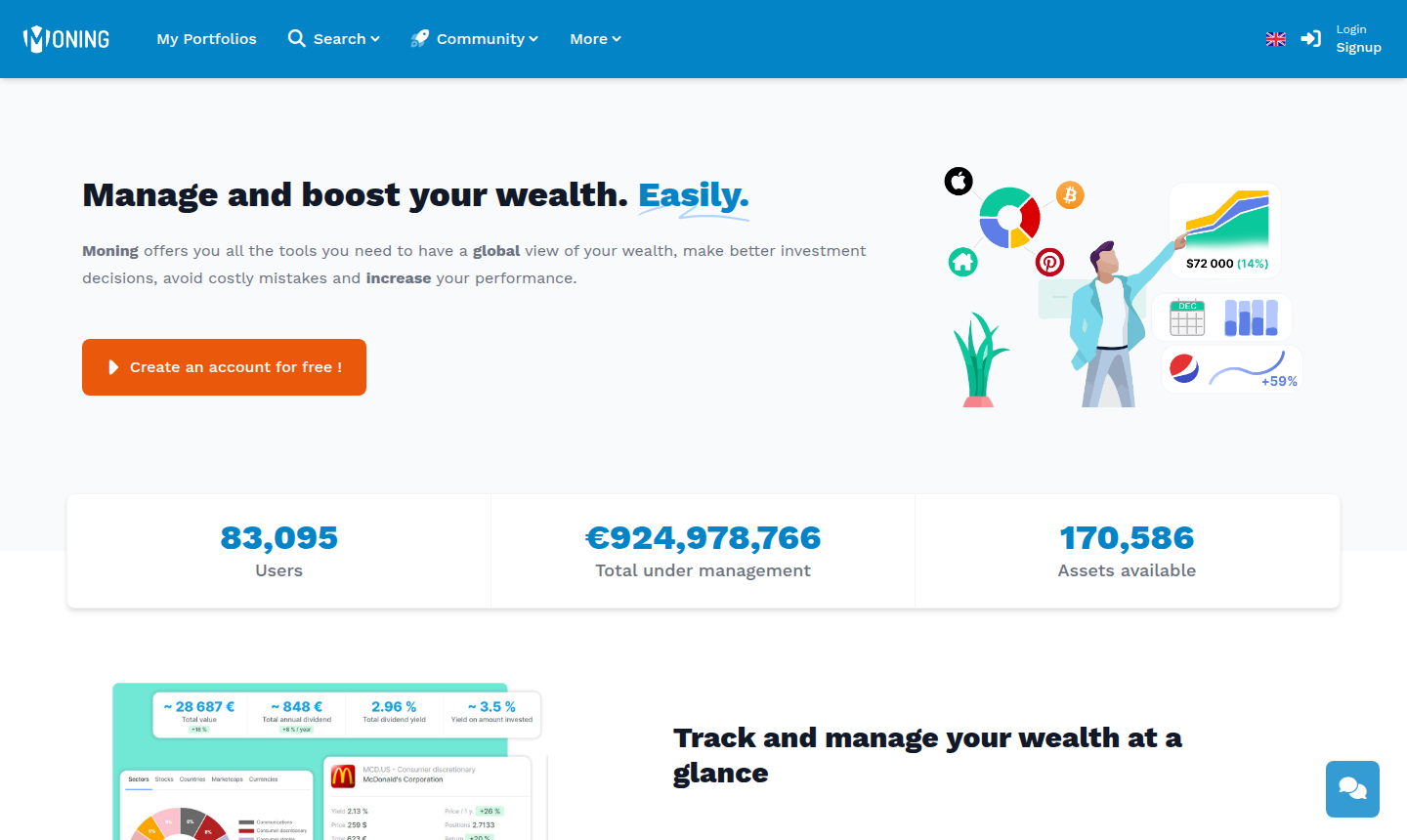

Moning is a comprehensive wealth management platform that helps investors track portfolios, analyze performance, and make data-driven investment decisions. The platform offers AI-powered analytics, dividend tracking, stock safety scores, and screening tools for stocks, ETFs, and cryptocurrencies. Designed for both individual investors and financial advisors seeking to optimize their investment strategies with advanced market insights and portfolio monitoring capabilities.

Overview of Moning

Moning serves as a comprehensive wealth management solution for modern investors seeking to optimize their financial portfolios. The platform integrates advanced analytics with user-friendly tools to provide real-time insights into investment performance across various asset classes including stocks, ETFs, and cryptocurrencies. Investors can benefit from Moning's data-driven approach to portfolio management, which helps identify opportunities and mitigate risks through systematic analysis.

Designed for both individual investors and financial professionals, Moning offers a centralized dashboard that aggregates investment data from multiple sources. The platform's intuitive interface makes complex financial analysis accessible to users with varying levels of investment experience. Explore related tools in Investment, Finance, and Analytics categories for complementary solutions.

How to Use Moning

Getting started with Moning involves creating a free account and connecting your investment portfolios through secure API integrations. Once set up, users can navigate the comprehensive dashboard to view portfolio performance metrics, track dividend payments, and access AI-generated investment insights. The platform's screening tools allow for filtering investment opportunities based on customized criteria and risk preferences.

Regular use of Moning includes monitoring safety scores for existing holdings, setting up alerts for market movements, and utilizing the dividend calendar for income planning. The platform's mobile accessibility ensures investors can stay informed about portfolio changes and market developments from anywhere, enabling timely decision-making and strategy adjustments.

Core Features of Moning

- AI-powered investment analytics – Generate intelligent insights from market data

- Portfolio tracking dashboard – Monitor performance across all investments

- Dividend calendar – Plan income streams from dividend payments

- Stock safety scores – Assess risk levels for individual securities

- Multi-asset screener – Filter stocks, ETFs, and cryptocurrencies

- Performance benchmarking – Compare returns against market indices

Use Cases for Moning

Individual investors utilize Moning for personal wealth management, tracking retirement accounts, college savings plans, and general investment portfolios. The platform helps retail investors make informed decisions by providing clear visibility into asset allocation, performance trends, and risk exposure. Moning serves as a valuable tool for those managing multiple investment accounts across different brokerages.

Financial advisors employ Moning to enhance client service through detailed portfolio analysis and reporting capabilities. The platform supports professional investment management by streamlining client communications with visual performance reports and risk assessment tools. Moning also benefits investment clubs and family offices seeking consolidated views of collective investment activities and coordinated strategy implementation.

Support and Contact

Moning provides customer support through email and an online knowledge base. Users can access educational resources and troubleshooting guides through the platform's help center. For specific inquiries or technical assistance, contact the support team at contact@moning.co or visit the contact page for additional communication options.

Company Info

Moning operates as a financial technology company focused on democratizing investment management tools. The company develops innovative solutions that make sophisticated portfolio analysis accessible to investors of all experience levels. Additional information about the company's mission and development team is available on the about page.

Login and Signup

New users can create a Moning account through the registration page to access basic features at no cost. Existing users can access their accounts via the login portal to manage portfolios and utilize advanced analytical tools. The platform offers seamless authentication options for secure account access across devices.

Moning FAQ

What types of investments can I track with Moning?

Moning supports tracking for stocks, exchange-traded funds (ETFs), and cryptocurrencies across multiple brokerages and exchanges. The platform allows investors to consolidate their entire investment portfolio in one dashboard, providing comprehensive visibility into different asset classes and their performance metrics.

How does Moning's AI analysis help with investment decisions?

Moning's artificial intelligence algorithms analyze market trends, company fundamentals, and portfolio performance to generate actionable insights. The AI system identifies patterns and correlations that might be difficult for individual investors to detect manually, providing data-driven recommendations for portfolio optimization and risk management.

Is there a mobile app available for Moning?

Yes, Moning offers mobile applications for both iOS and Android devices, allowing investors to monitor their portfolios and receive market alerts on the go. The mobile experience provides essential functionality while maintaining the platform's intuitive interface design for convenient access to investment information from anywhere.

What security measures does Moning implement to protect user data?

Moning employs bank-level encryption, multi-factor authentication, and secure API connections to protect user information and investment data. The platform follows industry best practices for data privacy and regularly undergoes security audits to ensure the highest standards of protection for sensitive financial information.

Can financial advisors use Moning for client portfolio management?

Absolutely, Moning provides specialized features for financial advisors including client reporting tools, performance analytics, and portfolio comparison capabilities. The platform supports multiple client accounts under a single advisor login, making it efficient for professionals to manage and monitor various investment portfolios while maintaining separate visibility for each client relationship.

How accurate are the safety scores provided by Moning?

Moning's safety scores are calculated using comprehensive financial metrics including volatility analysis, debt ratios, cash flow stability, and market performance indicators. While no scoring system can guarantee future performance, Moning's methodology provides reliable risk assessment based on historical data and current financial health indicators to help investors make more informed decisions.

Moning Pricing

Current prices may vary due to updates

Free Plan

Basic portfolio tracking with limited analytical features, dividend calendar access, and standard screening tools. Suitable for individual investors starting their investment journey who need fundamental tracking capabilities without advanced analytics.

Moning Reviews0 review

Would you recommend Moning? Leave a comment

Moning Alternatives

The best modern alternatives to the tool