RunStocks

RunStocks provides historical gap and run data for small-cap stocks, helping traders make informed decisions. Access over 8,000 events since 2022 with AI insights, 1-minute candlestick charts, and fundamental data. Ideal for day traders, swing traders, and anyone analyzing high-volatility markets.

Overview of RunStocks

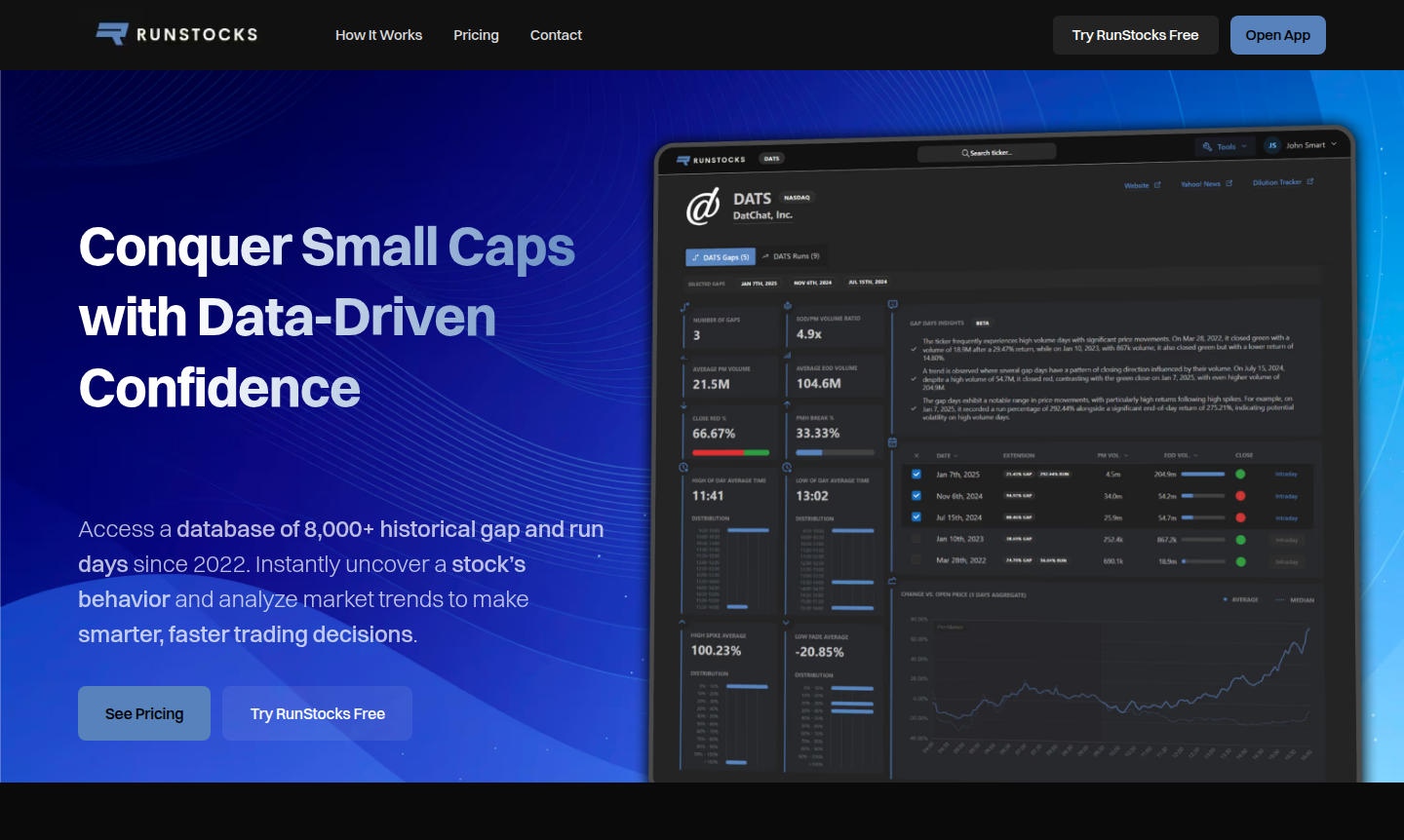

RunStocks empowers traders to conquer small caps with data-driven confidence by providing access to a comprehensive database of over 8,000 historical gap and run days since 2022. This allows users to instantly uncover a stock's behavior and analyze market trends, leading to smarter and faster trading decisions. By leveraging historical patterns and volume analysis, traders can avoid guesswork and base their moves on verified data, improving their overall strategy and success rate in high-volatility markets.

Ideal for active traders who specialize in high-volatility small-cap stocks, RunStocks is tailored for those engaged in pre-market momentum, intraday breakouts, or second-day plays. The platform's features, such as stock-specific character analysis, intraday price action with 1-minute candlestick data, and AI-enhanced insights, provide a competitive edge. Users can filter historical events based on current market conditions and access fundamental data like float size and insider ownership. Discover more tools in the Exchange Platform and Portfolio Tracker categories.

How to Use RunStocks

Using RunStocks involves a straightforward workflow: start by searching for a ticker among 6,000+ stocks from NASDAQ, NYSE, and other markets. Then, check key fundamentals like float size, outstanding shares, and insider ownership. Next, analyze historical gaps and runs since 2022, and filter them based on today's conditions such as pre-market volume or gap percentage. After that, anticipate the market move by reviewing past behavior under similar circumstances, break down price action with detailed 1-minute candlestick charts, and finally trade with confidence using all the gathered data.

Core Features of RunStocks

- Stock-Specific Character Analysis – Uncover unique trading patterns and behaviors for individual stocks to predict gap and run outcomes.

- Intraday Price Action – View detailed 1-minute candlestick charts for every gap day to analyze precise price movements.

- AI-Enhanced Insights – Receive AI-generated summaries and three key takeaways from historical data for quick decision-making.

- Comprehensive Historical Data – Access a vast database of gaps and runs since 2022, with filters for volume, timeframe, and trends.

Use Cases for RunStocks

- Day trading small-cap stocks with high volatility

- Analyzing pre-market gaps for momentum plays

- Identifying intraday breakout opportunities

- Planning second-day follow-up trades

- Swing trading based on historical gap data

- Researching stock behavior before investment

- Filtering historical events for current market conditions

Support and Contact

For support, email contact@runstocks.com or visit the contact page for more assistance.

Company Info

RunStocks is the company behind the platform. For more information, visit the about page.

Login and Signup

Login to your account at https://app.runstocks.com/ or sign up for free access.

RunStocks FAQ

What does RunStocks do?

RunStocks is an analytics platform for small-cap day traders, providing historical data on stocks with gaps of 20% or more and runs of 50% or more since 2022 to improve trading decisions.

Who is RunStocks for?

It's for active traders specializing in high-volatility small-cap stocks, including those trading pre-market momentum, intraday breakouts, or second-day plays.

What is a gap and what is a run?

A gap is when a stock opens 20% or higher than its previous close; a run is an intraday gain of 50% or more from the opening price.

How accurate is RunStocks data?

Data is updated daily, adjusted for reverse splits, and cross-checked with multiple sources to ensure reliability for trading insights.

Is there free access to RunStocks?

Yes, free access includes ticker-specific data for the last 4 months and market-wide analysis for the last 7 days, with limitations.

RunStocks Pricing

Current prices may vary due to updates

Free

Access to ticker-specific gap and run data for the last 4 months, and market-wide analysis for the last 7 days. Ideal for beginners or occasional trad

Pro

Unlocks the entire historical dataset since 2022, with full access to all features, including comprehensive data, AI insights, advanced filtering, and

RunStocks Reviews0 review

Would you recommend RunStocks? Leave a comment