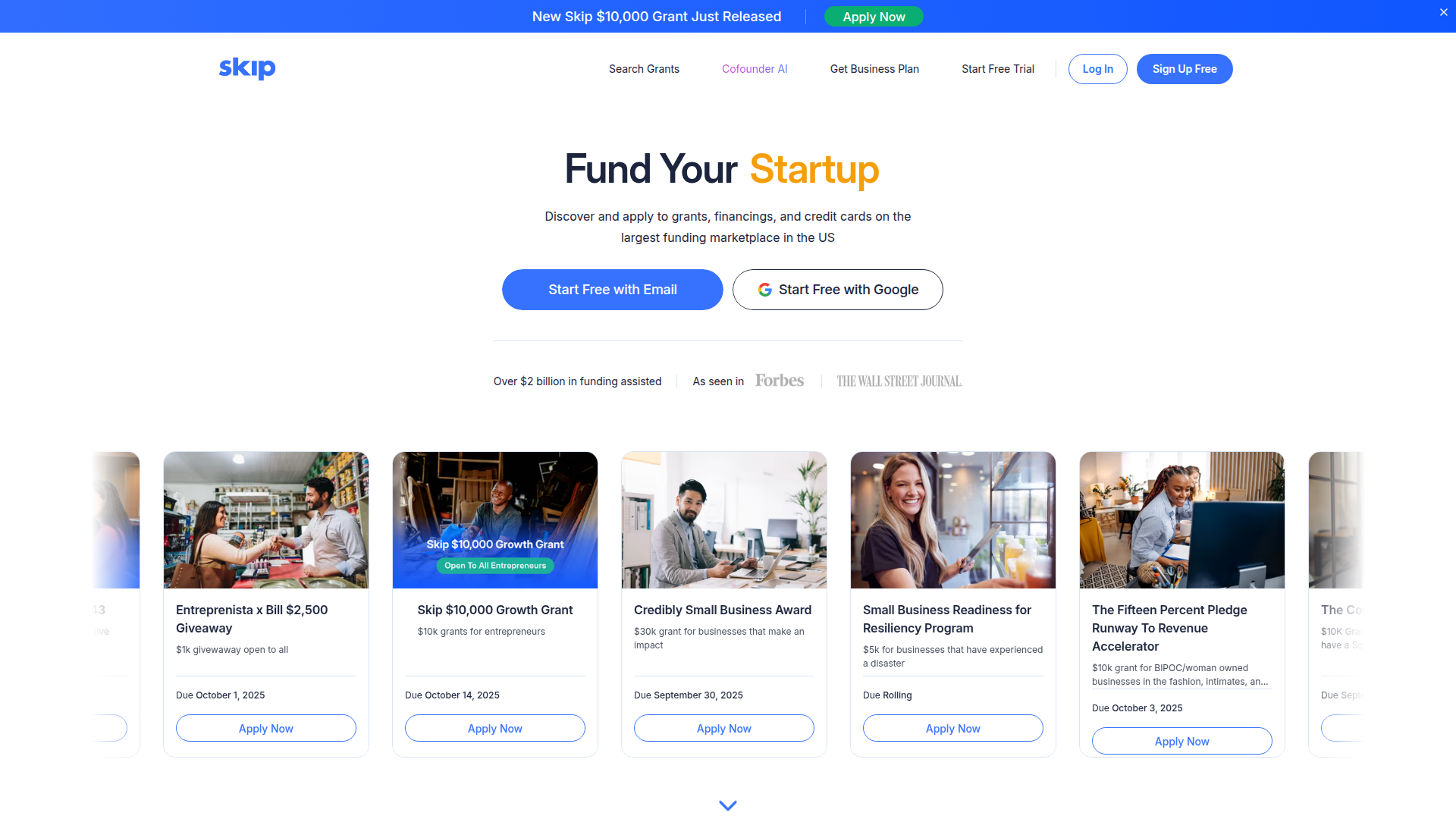

Skip operates as the largest funding marketplace in the United States, serving as a centralized hub for businesses seeking capital and financial products. The platform helps business owners discover, compare, and apply for various funding options including business grants, loans, lines of credit, and business credit cards. By aggregating opportunities into a single marketplace, Skip simplifies the complex process of securing business funding, making it easier for entrepreneurs to find resources to start, operate, and grow their ventures efficiently.

Overview of Skip Funding Marketplace

Skip Funding Marketplace represents a comprehensive financial technology platform designed specifically for businesses seeking various forms of capital and financial solutions. As the largest funding marketplace in the United States, Skip serves as a centralized hub where entrepreneurs and business owners can access diverse funding opportunities tailored to their specific requirements. The platform's primary function involves helping businesses discover, compare, and apply for funding options including business grants that provide non-repayable funds, various financing solutions such as loans and lines of credit, and specialized business credit cards.

The platform addresses the significant challenge many businesses face when navigating the complex landscape of business financing. By aggregating numerous funding opportunities into a single, accessible marketplace, Skip eliminates the need for business owners to research multiple lenders and programs individually. This streamlined approach not only saves valuable time but also increases the likelihood of finding suitable funding options that match specific business needs and qualifications. Skip's services are particularly valuable for business planning and financial management professionals seeking comprehensive funding solutions.

How to Use Skip Funding Marketplace

Using Skip begins with creating a business profile that captures essential information about your company, including industry type, revenue figures, funding requirements, and specific financial needs. The platform's intelligent matching algorithm then analyzes this information to present personalized funding recommendations from its extensive network of lenders and grant providers. Business owners can easily compare different options side by side, examining factors such as interest rates, repayment terms, eligibility criteria, and application requirements before making informed decisions.

The application process through Skip is designed for maximum efficiency and convenience. Instead of completing multiple separate applications for different funding sources, users can often submit a single unified application that gets distributed to relevant lenders within Skip's network. The platform provides real-time status updates on applications and offers guidance throughout the entire process, from initial submission to final funding disbursement. This centralized approach significantly reduces the administrative burden on business owners while increasing their chances of securing appropriate financing.

Core Features of Skip Funding Marketplace

- Comprehensive funding database – Access to thousands of lenders and grant programs

- Intelligent matching algorithm – Personalized funding recommendations based on business profile

- Unified application system – Single application for multiple funding opportunities

- Comparison tools – Side-by-side analysis of different funding options

- Real-time status tracking – Monitor application progress through dashboard

- Educational resources – Guides and information about business financing

- Secure document handling – Protected submission of financial documents

Use Cases for Skip Funding Marketplace

Skip serves a wide range of business scenarios and industries requiring financial support. Startups and new businesses utilize the platform to secure initial capital for launching operations, purchasing equipment, and covering early-stage expenses. Established small and medium enterprises use Skip to access growth capital for expansion projects, inventory purchases, hiring additional staff, or entering new markets. The platform also serves businesses facing temporary cash flow challenges or those seeking to consolidate existing debt under more favorable terms.

Specific industry applications include retail businesses seeking inventory financing, technology companies requiring capital for research and development, service-based businesses needing equipment upgrades, and seasonal businesses requiring working capital during off-peak periods. Non-profit organizations and social enterprises can also benefit from Skip's grant discovery features, identifying funding opportunities that support their specific missions and community initiatives. The platform's diverse funding options make it suitable for virtually any business type seeking financial assistance.

Support and Contact

Skip provides comprehensive customer support through multiple channels to assist users with their funding journey. Businesses can access help resources through the platform's knowledge base or contact support representatives directly for personalized assistance. The support team assists with profile setup, application questions, funding comparisons, and technical issues. Users can reach Skip support through the official contact form or via email at contact@helloskip.com for prompt assistance with their funding needs.

Company Info

Skip operates as a financial technology company based in the United States, specializing in business funding solutions. The company focuses on democratizing access to capital for businesses of all sizes through its innovative marketplace platform.

Login and Signup

Business owners can create a Skip account to access funding opportunities or log in to existing accounts to manage applications and track funding progress through the platform's dashboard interface.

Skip Funding Marketplace FAQ

What types of funding options are available through Skip?

Skip provides access to multiple funding options including business grants that offer non-repayable funds, traditional business loans with various terms, lines of credit for flexible borrowing, and specialized business credit cards. The platform also offers equipment financing, invoice factoring, and SBA loans through its extensive network of lenders and financial institutions.

How does Skip's matching algorithm work for funding recommendations?

Skip's intelligent matching algorithm analyzes your business profile information including industry type, revenue, credit history, funding needs, and specific requirements. The system then compares this data against its extensive database of lenders and funding programs to identify the most suitable matches. Skip's algorithm considers eligibility criteria, approval likelihood, and optimal terms to provide personalized funding recommendations that align with your business objectives.

Is there a cost to use Skip's funding marketplace platform?

Skip does not charge businesses any upfront fees to access its funding marketplace platform. The service is free for business owners to create profiles, receive funding recommendations, and compare options. Skip generates revenue through partnerships with lenders who pay fees when successful funding connections are made. This means businesses can use Skip's matching and comparison tools without any cost obligations until they actually secure funding through the platform.

How long does it typically take to receive funding through Skip?

The timeline for receiving funding through Skip varies depending on the type of financing, lender requirements, and completeness of your application. Business grants may take several weeks to months for approval and disbursement, while traditional business loans typically process within 2-6 weeks. Lines of credit and business credit cards often have faster approval times, sometimes within a few business days. Skip's streamlined application process helps accelerate funding timelines by ensuring all required documentation is properly submitted and following up with lenders throughout the process.

What types of businesses are eligible to use Skip's funding services?

Skip serves a wide range of business types including startups, small businesses, medium-sized enterprises, and established corporations across various industries. Eligibility requirements vary by funding type but generally include businesses operating legally in the United States, with valid business registration, and meeting minimum revenue or time-in-business criteria. Both for-profit and non-profit organizations can use Skip, though specific funding options may have additional eligibility requirements based on industry, credit history, revenue levels, and business purpose.

How does Skip ensure the security of business financial information?

Skip employs bank-level security measures including 256-bit SSL encryption, secure socket layer technology, and regular security audits to protect business financial information. The platform follows strict data protection protocols and complies with financial industry security standards. All sensitive data is encrypted both in transit and at rest, and Skip never shares business information with unauthorized third parties. The platform also provides secure document upload capabilities and multi-factor authentication options to ensure only authorized users can access business financial profiles and applications.

Skip Funding Marketplace Pricing

Current prices may vary due to updates

Free Business Matching

Skip provides completely free access to its funding marketplace platform for business owners. This includes profile creation, funding opportunity matching, comparison tools, educational resources, and application assistance. Businesses can explore all available funding options, receive personalized recommendations, and compare terms without any cost. Skip generates revenue through lender partnerships rather than charging businesses fees, making professional funding assistance accessible to companies of all sizes at no upfront cost.

Skip Funding Marketplace Reviews0 review

Would you recommend Skip Funding Marketplace? Leave a comment

Skip Funding Marketplace Alternatives

The best modern alternatives to the tool