Annotation

- Introduction

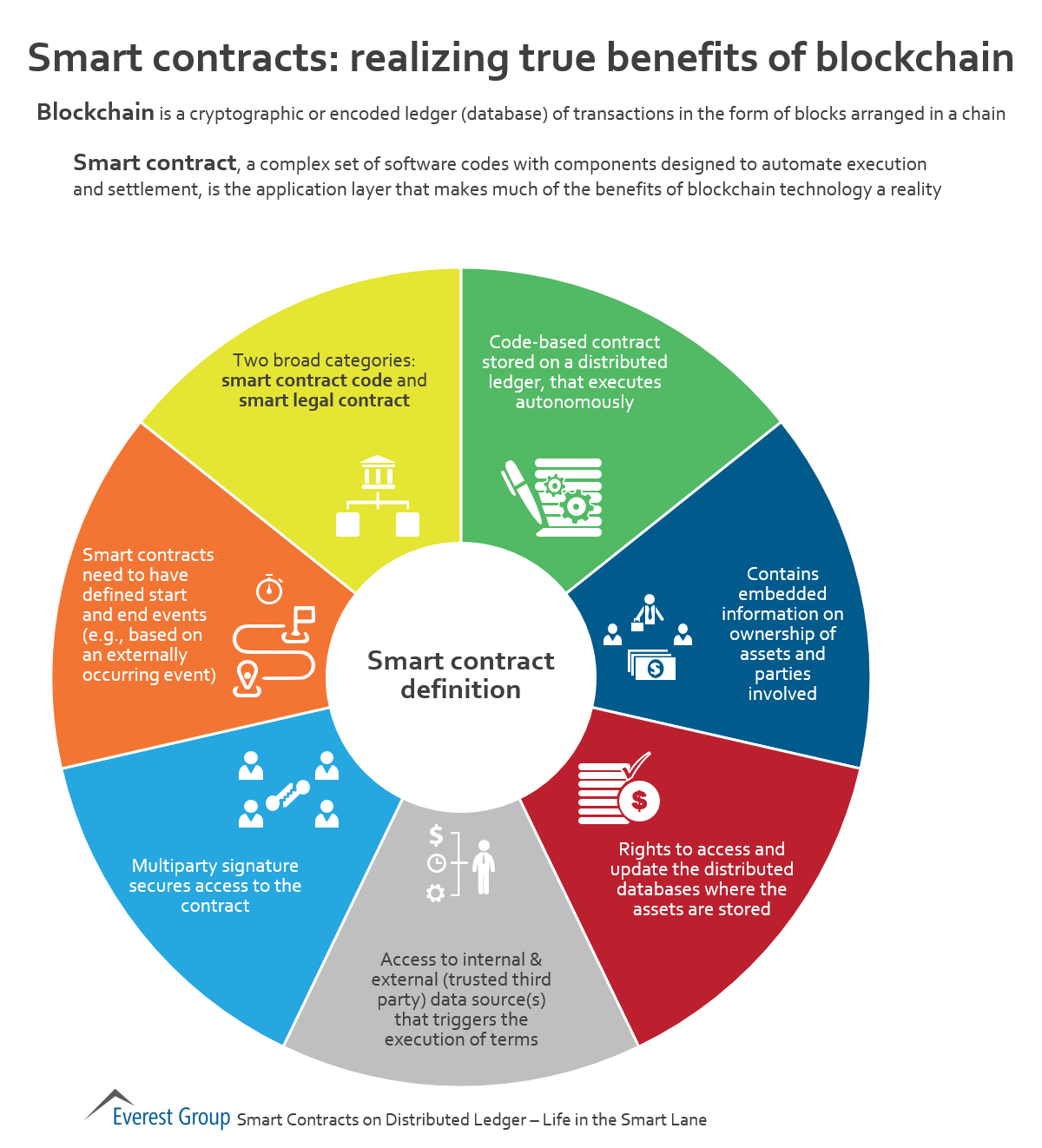

- What Are Smart Contracts?

- Smart Contracts vs Traditional Contracts

- How Smart Contracts Work Technically

- Smart Contracts in Crowdfunding

- Getting Started with Development

- Key Technical Features

- Real-World Applications

- Pros and Cons

- Conclusion

- Frequently Asked Questions

Smart Contracts Guide 2025: How Blockchain Agreements Work & Examples

Smart contracts are self-executing agreements on blockchain that automate processes without intermediaries, used in DeFi, supply chain, and more.

Introduction

Smart contracts represent one of blockchain technology's most transformative applications, enabling automated, trustless agreements without intermediaries. These self-executing contracts encode business logic directly into code that runs on decentralized networks like Ethereum. As we move through 2025, smart contracts continue revolutionizing industries from finance to supply chain management by providing unprecedented transparency, security, and efficiency in digital agreements.

What Are Smart Contracts?

Smart contracts are programmable agreements stored on blockchain networks that automatically execute when predetermined conditions are met. Unlike traditional legal documents written in natural language, smart contracts use code to define terms, conditions, and outcomes. This automation eliminates the need for intermediaries like lawyers, banks, or escrow services while ensuring tamper-proof execution through blockchain's distributed ledger technology.

The fundamental innovation lies in their ability to transform complex legal and business agreements into deterministic code that executes exactly as programmed. When parties agree to terms, these conditions get encoded into the contract's logic. Once deployed on a blockchain, the contract becomes immutable and transparent – visible to all participants but unchangeable by any single entity. This creates what's often called "trustless trust," where participants can rely on the code's execution rather than trusting counterparties or intermediaries.

The Genesis of Smart Contracts

Computer scientist and cryptographer Nick Szabo first conceptualized smart contracts in 1997, long before blockchain technology existed. Szabo envisioned automated contractual clauses embedded in hardware and software to reduce fraud and transaction costs. His famous analogy compared smart contracts to vending machines – automated systems that execute transactions without human intervention once conditions are met.

Szabo's vision included using cryptographic techniques to secure digital agreements for property rights, financial instruments, and commercial transactions. While the technology of his era couldn't fully realize this vision, his theoretical framework directly influenced blockchain developers who later implemented smart contracts on platforms like Ethereum. Szabo's work highlighted how code could automate trust and reduce reliance on legal systems, laying the foundation for today's decentralized agreement revolution.

Smart Contracts vs Traditional Contracts

The differences between smart contracts and traditional legal agreements extend beyond their technical implementation to fundamental philosophical approaches about trust and enforcement. Traditional contracts rely on legal systems, courts, and human interpretation for enforcement, creating potential for delays, misunderstandings, and expensive disputes. Smart contracts, by contrast, execute automatically based on coded conditions, removing interpretation ambiguity and intermediary dependencies.

Traditional contracts operate within established legal frameworks that have evolved over centuries, providing well-understood dispute resolution mechanisms but often requiring significant time and resources for enforcement. Smart contracts introduce a paradigm where code becomes law – the agreement executes precisely as written without requiring external enforcement. This doesn't necessarily replace traditional legal systems but creates complementary automated execution layers for suitable use cases.

For businesses exploring blockchain solutions, understanding when to use smart contracts versus traditional agreements involves evaluating factors like complexity, legal requirements, and the need for human judgment. Many hybrid approaches now combine smart contract automation with traditional legal frameworks to leverage the strengths of both systems while mitigating their respective limitations.

How Smart Contracts Work Technically

Smart contracts operate through a sophisticated technical stack that combines blockchain infrastructure, programming languages, and cryptographic security. When a smart contract deploys to a blockchain network, it becomes a special type of account containing both code and storage. The contract's bytecode distributes across network nodes, while its state variables track the agreement's current status on the distributed ledger.

Execution begins when users or other contracts send transactions to the smart contract's address. These transactions trigger functions defined in the contract code, which then execute across the network's nodes. Each node validates the transaction and executes the code independently, reaching consensus about the outcome through the blockchain's protocol. This distributed execution ensures that no single entity controls the contract's operation while providing cryptographic proof of proper execution.

The technical architecture involves several critical components: the virtual machine that executes contract code (like Ethereum's EVM), the programming language (typically Solidity for Ethereum), gas mechanisms that prevent resource abuse, and event systems that allow external applications to monitor contract activity. Understanding these technical foundations helps developers create secure, efficient contracts and enables businesses to evaluate appropriate use cases for their needs.

Smart Contracts in Crowdfunding

Crowdfunding represents one of smart contracts' most compelling practical applications, demonstrating how blockchain technology can create more transparent and efficient funding mechanisms. Traditional crowdfunding platforms like Kickstarter act as trusted intermediaries holding funds until projects meet their goals. Smart contracts automate this process through coded conditions that automatically release funds when targets are met or refund contributions when they're not.

In a smart contract-based crowdfunding system, project creators define funding goals, deadlines, and distribution rules in the contract code. Contributors send cryptocurrency to the contract address, where funds remain locked until conditions are satisfied. The contract automatically verifies whether the funding goal was achieved by the deadline and either transfers funds to the creator or returns them to contributors – all without human intervention or platform discretion.

This approach offers significant advantages over traditional models. Contributors don't need to trust a platform to handle funds properly since the contract's transparent code governs all actions. Project creators receive immediate access to funds when conditions are met, avoiding platform holding periods. The system also reduces platform fees and administrative overhead while providing immutable records of all transactions. As NFT platforms and token creation tools evolve, smart contract crowdfunding continues integrating with broader blockchain ecosystems.

Getting Started with Development

Choosing Blockchain Platforms

Selecting the right blockchain platform represents the first critical decision in smart contract development. While Ethereum remains the most established platform with the largest ecosystem, developers now have multiple options each offering different trade-offs. Ethereum provides maximum security, decentralization, and tooling maturity but faces challenges with scalability and transaction costs during network congestion.

Alternative platforms like Binance Smart Chain offer lower fees and higher throughput but with varying degrees of decentralization. Emerging platforms like Solana, Cardano, and Polkadot introduce novel consensus mechanisms and scalability solutions while building their developer communities. The choice depends on project requirements including transaction volume, cost sensitivity, security needs, and existing developer expertise.

Evaluation criteria should include transaction finality speed, development tool maturity, programming language support, community activity, and interoperability with other networks. Many projects now adopt multi-chain strategies, deploying contracts across multiple platforms to leverage different strengths while reaching broader user bases. The evolving smart contract platform landscape continues offering new options as blockchain technology matures.

Learning Solidity Programming

Solidity serves as the primary programming language for Ethereum smart contracts, featuring syntax similarities to JavaScript and C++ while incorporating blockchain-specific constructs. Learning Solidity involves understanding unique concepts like gas optimization, security patterns, and the contract lifecycle from development through deployment and maintenance.

Key Solidity concepts include state variables that persist on blockchain storage, functions that define contract behavior, modifiers that control access, events that enable external monitoring, and error handling mechanisms. The language also supports complex data structures, inheritance patterns, and library integrations that enable sophisticated contract architectures. Security considerations remain paramount, requiring understanding of common vulnerabilities like reentrancy attacks, integer overflows, and access control flaws.

Development tools have matured significantly, with integrated development environments like Remix providing browser-based coding, testing frameworks like Truffle and Hardhat enabling comprehensive testing, and security analysis tools like Slither and Mythril helping identify vulnerabilities. The vibrant Solidity community offers extensive documentation, tutorials, and open-source examples that accelerate learning while established best practices guide secure development approaches.

Understanding Deployment Costs

Smart contract deployment and execution on Ethereum involve gas costs that compensate network validators for computational resources. Gas represents a unit measuring computational effort, with each operation consuming specific gas amounts. The total transaction cost calculates as gas used multiplied by gas price, creating an economic model that prioritizes network resources while preventing abuse.

Gas costs fluctuate based on network demand, creating variable deployment expenses that developers must consider during planning. Complex contracts with extensive code and storage requirements incur higher deployment costs, while contract interactions consume gas based on computational complexity during execution. Understanding these economics helps developers optimize contract architecture and users budget for interaction costs.

Optimization strategies include code minimization, efficient data storage patterns, batch processing of operations, and gas token mechanisms that offset costs during high network congestion. Developers can estimate costs using tools like ETH Gas Station and network wallets while testing on testnets before mainnet deployment. As crypto wallets and blockchain explorers evolve, they increasingly incorporate gas estimation features that help users manage transaction costs effectively.

Key Technical Features

Immutability and Distribution

Immutability and distribution form the foundational properties that make smart contracts uniquely trustworthy compared to traditional systems. Immutability ensures that once deployed, contract code cannot be modified – creating certainty that terms will execute exactly as programmed. This prevents tampering, unauthorized changes, and retrospective alterations that could disadvantage participants.

Distribution means contract code and state replicate across numerous network nodes rather than residing on centralized servers. This eliminates single points of failure, prevents censorship, and ensures contract availability even if some nodes go offline. The combination of these properties creates resilient systems where participants can verify contract behavior independently while trusting that no single entity controls execution.

These technical characteristics enable novel business models and applications impossible with traditional systems. They facilitate staking mechanisms, decentralized governance, and transparent financial systems where all participants operate on equal footing with verifiable rules. As blockchain technology evolves, new approaches like upgradeable contracts and layer-2 solutions provide flexibility while maintaining these core trust properties.

Real-World Applications

Industry Transformation Examples

Smart contracts drive transformation across numerous industries by automating processes, increasing transparency, and reducing friction in multi-party interactions. In finance, they power decentralized lending platforms, automated market makers, and synthetic asset creation – collectively known as DeFi. These applications eliminate traditional financial intermediaries while providing global access to financial services through DeFi dashboards and interfaces.

Supply chain management leverages smart contracts to track goods, verify authenticity, automate payments, and ensure compliance throughout complex logistics networks. Each transfer of custody, quality verification, or milestone achievement can trigger automated contract executions that update ownership records, release payments, or notify participants – all with immutable audit trails.

Insurance represents another promising application area where smart contracts automate claims processing for parametric insurance products. Policies can automatically pay claims when verifiable conditions occur – like flight delays verified through oracle data or natural disasters confirmed through trusted sources. This eliminates manual claims assessment while providing immediate payout upon qualifying events.

Other applications include real estate transactions that automate title transfers and escrow releases, voting systems that ensure tamper-proof tallies, healthcare data management that controls access while maintaining privacy, and intellectual property licensing that automatically distributes royalties. The common thread across these applications is replacing manual, opaque processes with automated, transparent executions that reduce costs while increasing trust among participants.

Pros and Cons

Advantages

- Automated execution eliminates manual processing delays

- Transparent terms visible to all participants on blockchain

- Reduced costs by removing intermediary fees and overhead

- Enhanced security through cryptographic protection and distribution

- Trust minimization since code execution replaces counterparty trust

- Global accessibility without geographic restrictions or banking requirements

- Immutability ensures terms cannot be altered after deployment

Disadvantages

- Code vulnerabilities can lead to irreversible fund losses if not properly audited

- Legal uncertainty in many jurisdictions regarding enforcement and compliance

- Immutability prevents bug fixes without deploying entirely new contracts

- Complex development requires specialized blockchain programming skills

- Scalability limitations on some networks during high usage periods

Conclusion

Smart contracts represent a fundamental shift in how agreements are created, executed, and enforced in the digital age. By encoding business logic into tamper-proof code that runs on decentralized networks, they enable trust-minimized interactions that reduce costs, increase transparency, and automate complex processes across industries. While challenges remain around scalability, legal frameworks, and security, the continued evolution of blockchain technology and developer tools addresses these limitations while expanding possible applications. As businesses and developers increasingly understand and adopt smart contracts, they'll continue transforming traditional industries while enabling entirely new economic models built on programmable, automated agreements.

Frequently Asked Questions

Are smart contracts legally binding?

The legal status varies by jurisdiction. Some US states and countries explicitly recognize smart contracts as legally valid, while others are still developing regulations. Most experts recommend combining smart contracts with traditional legal frameworks for important agreements.

What are the main limitations of smart contracts?

Key limitations include code vulnerabilities requiring thorough auditing, immutability preventing bug fixes after deployment, legal uncertainty in some regions, complexity requiring specialized skills, and scalability challenges during high network usage periods.

How do I audit a smart contract for security?

Security auditing involves manual code review, automated analysis with tools like Slither and Mythril, comprehensive testing, and often professional third-party audits. Best practices include multiple audit stages and bug bounty programs before mainnet deployment.

What programming language is used for Ethereum smart contracts?

Solidity is the primary language for Ethereum smart contracts. It has syntax similar to JavaScript and includes blockchain-specific features for security, gas optimization, and decentralized application development.

What are the common use cases for smart contracts?

Common use cases include decentralized finance (DeFi) applications, supply chain management, insurance claims automation, voting systems, real estate transactions, and intellectual property licensing.