Annotation

- Introduction

- Key Points

- The Inefficiency of Traditional Lead Vendors

- Unlocking AI Power: Meta (Facebook) as a Prediction Machine

- The Power of Conversion Goals and the Conversion API

- The Feedback Loop: Training Facebook's AI for Optimal Lead Generation

- Step-by-Step Guide: Implementing AI for Insurance Lead Generation

- Pros and Cons

- Conclusion

- Frequently Asked Questions

AI Lead Generation for Insurance Agents: Meta Facebook Strategies

Insurance agents can leverage AI and Meta's Facebook platform for efficient lead generation, using precise targeting and Conversion API to improve

Introduction

In today's highly competitive insurance landscape, generating qualified leads has become the cornerstone of sustainable business growth. While many insurance professionals still rely on traditional lead vendors, a more sophisticated approach involves leveraging Artificial Intelligence (AI) to transform lead generation. This comprehensive guide explores how insurance agents can harness Meta's (Facebook) AI capabilities to dramatically improve lead quality, reduce acquisition costs, and ultimately drive higher conversion rates. We'll examine practical strategies for integrating AI into your marketing workflow, helping you build a consistent pipeline of qualified prospects ready for conversion.

Key Points

- Traditional lead vendors often deliver low-quality, unqualified leads with high competition

- Meta's AI functions as a sophisticated prediction engine using extensive user data

- The Conversion API is essential for feeding quality data back to Facebook's algorithms

- Optimize campaigns for specific conversion goals like booked appointments and sales

- AI enables precise targeting of demographics with high conversion potential

- Continuous data feedback improves lead quality over time through machine learning

The Inefficiency of Traditional Lead Vendors

Why Buying Leads is Suboptimal

Many insurance agents begin their careers by purchasing leads from third-party vendors, assuming this provides a quick path to client acquisition. However, this traditional approach often yields disappointing results due to fundamental flaws in the lead generation model. These vendors operate on volume-based economics, prioritizing quantity over quality to maximize their profit margins. The result is a system where agents receive leads that may look promising on paper but rarely convert into actual clients.

Lead vendors typically employ broad targeting methods that capture anyone who might be remotely interested in insurance products. This creates several significant challenges for insurance professionals. First, the leads often lack specific qualification criteria, meaning you might contact individuals who aren't actually in the market for insurance or don't meet underwriting requirements. Second, the same leads are frequently sold to multiple agents simultaneously, creating intense competition where you're racing against other professionals for the same prospects. Third, and most critically, these vendors operate without meaningful feedback loops – they never learn which leads actually convert, so they can't improve their targeting over time. This makes traditional lead purchasing an expensive, time-consuming endeavor with diminishing returns.

Unlocking AI Power: Meta (Facebook) as a Prediction Machine

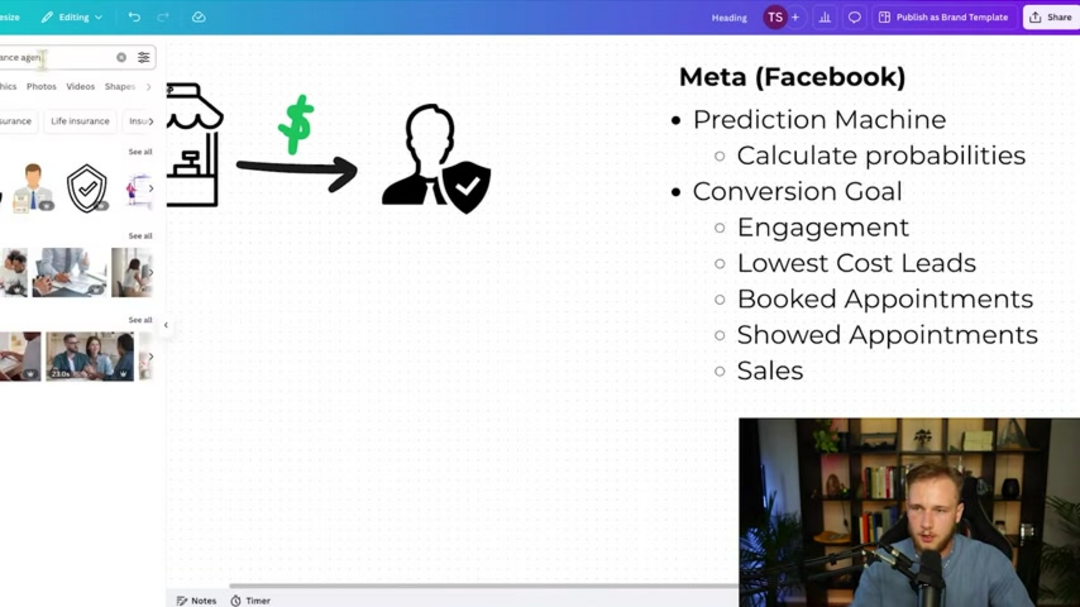

Understanding Meta's AI Capabilities

Meta (Facebook) has evolved into one of the world's most sophisticated prediction engines, leveraging artificial intelligence and massive datasets to forecast user behavior with remarkable accuracy. The platform processes approximately 52,000 data points per user, enabling it to calculate the probability of specific actions with impressive precision. This predictive capability represents a game-changing opportunity for insurance agents seeking high-quality leads. Unlike traditional methods that cast wide nets, Meta's AI allows for surgical targeting of individuals most likely to become valuable clients.

While many people associate AI with chatbots and virtual assistants, Meta's AI capabilities extend far beyond basic conversational interfaces. The platform's machine learning models are specifically trained on user behavior patterns, purchase history, and engagement metrics, making them exceptionally well-suited for identifying insurance prospects. These models continuously learn and adapt based on new data, becoming more effective at lead generation over time. For insurance agents, this means moving beyond generic marketing approaches to precisely target individuals based on income levels, life stages, financial behaviors, and specific insurance needs.

The Power of Conversion Goals and the Conversion API

To maximize Meta's AI potential, insurance agents must define clear conversion goals that align with their business objectives. These goals serve as training signals for the AI, helping it understand what constitutes a valuable outcome. Common conversion goals for insurance professionals include engagement metrics (likes, comments, shares), lead generation at various cost points, booked appointments, showed appointments, and direct policy sales. Each goal requires different targeting strategies and ad creative approaches.

The Conversion API plays a crucial role in this process by enabling two-way data communication between your systems and Meta's AI. This tool allows you to send detailed conversion data back to Facebook, including information about which leads resulted in actual sales, which appointments were kept, and which prospects demonstrated genuine interest. This feedback mechanism enables the AI to refine its targeting algorithms continuously. For example, by providing data about converted clients' income levels, employment status, and retirement savings patterns, you train the AI to seek similar profiles in the future. This creates a virtuous cycle where lead quality improves with each campaign iteration.

The Feedback Loop: Training Facebook's AI for Optimal Lead Generation

The core advantage of AI-driven lead generation lies in the continuous feedback loop between your business outcomes and Meta's learning algorithms. This process transforms lead generation from a static activity into an evolving, self-improving system. The feedback mechanism works through several interconnected steps that create a powerful learning cycle for the AI.

Begin by running targeted ad campaigns designed to resonate with your ideal client profile. These campaigns should incorporate compelling messaging that addresses specific insurance needs and pain points. As leads come in, meticulously track their quality and conversion potential through your CRM system. The critical step involves using the Conversion API to send this performance data back to Facebook, providing the AI with concrete examples of what constitutes a successful lead. Based on this feedback, Facebook's algorithms automatically adjust targeting parameters to focus on individuals who share characteristics with your best-converted leads. This ongoing optimization process means your lead generation becomes increasingly effective over time, with the AI learning from both successes and failures to refine its approach.

Step-by-Step Guide: Implementing AI for Insurance Lead Generation

Step 1: Define Your Ideal Client Profile

The foundation of successful AI-driven lead generation begins with a precisely defined ideal client profile. This goes beyond basic demographics to include detailed characteristics that predict insurance needs and purchasing behavior. Consider factors like age ranges, income brackets, geographic locations, occupation types, family status, and financial behaviors. Also incorporate psychographic elements such as values, lifestyle preferences, risk tolerance, and financial planning attitudes. The more specific your profile, the better Facebook's AI can identify matching individuals within its vast user base. This precision targeting is particularly valuable when exploring AI lead generation tools that require clear parameters to function effectively.

Step 2: Set Up Facebook Pixel and Conversion API

Technical implementation forms the backbone of AI-powered lead generation. The Facebook Pixel tracks user interactions on your website, providing valuable data about how prospects engage with your content before converting. Meanwhile, the Conversion API establishes a direct server-to-server connection that sends comprehensive conversion data back to Facebook, including offline conversions that occur outside the digital tracking environment. Proper configuration of both systems ensures accurate data collection and enables the AI to make informed targeting decisions. This technical foundation supports various AI automation platforms that can streamline your insurance marketing operations.

Step 3: Create Targeted Ad Campaigns

Developing effective ad campaigns requires balancing compelling creative elements with strategic targeting parameters. Create ad content that speaks directly to your ideal client's insurance concerns, whether that's life insurance for growing families, retirement planning for pre-retirees, or health coverage for self-employed individuals. Utilize Facebook's sophisticated targeting options to reach specific audience segments, or employ A/B testing methodologies to let the AI determine which approaches resonate best. Setting appropriate budget parameters helps the AI optimize spend across different audience segments and ad variations. These campaigns can be enhanced using social scheduler tools to maintain consistent visibility with your target audience.

Step 4: Optimize for Specific Conversion Goals

Campaign optimization begins with selecting the right conversion goal for your current business objectives. If you're focused on building initial prospect relationships, engagement or lead generation goals might be appropriate. For agents with established follow-up processes, booked appointments often represent the ideal conversion target. More advanced operations might optimize directly for policy sales. Each goal requires different ad structures, landing page designs, and follow-up sequences. The key is maintaining alignment between your conversion goal selection and your capacity to deliver on the promised action. This strategic approach complements various AI agents and assistants that can help manage customer interactions.

Step 5: Track, Analyze, and Refine

Continuous improvement forms the final component of AI-driven lead generation success. Regularly monitor campaign performance metrics, paying particular attention to conversion rates, cost per acquisition, and lead quality indicators. Analyze which audience segments, ad creatives, and messaging approaches yield the best results. Use these insights to refine your targeting parameters, creative elements, and conversion goal selection. Most importantly, ensure that performance data flows back to Facebook through the Conversion API, enabling the AI to incorporate your real-world results into its learning process. This analytical approach works well with conversational AI tools that can provide additional customer insights.

Pros and Cons

Advantages

- Significantly higher lead quality through precise AI targeting

- Reduced customer acquisition costs over traditional methods

- Continuous improvement through machine learning algorithms

- Data-driven insights for informed marketing decisions

- Scalable approach that grows with your business

- Better ROI compared to traditional lead vendors

- Automated optimization reduces manual campaign management

Disadvantages

- Requires initial technical setup and configuration

- Needs ongoing monitoring and optimization efforts

- Data privacy compliance requirements must be addressed

- Learning curve for agents unfamiliar with digital marketing

- Initial investment in tools and potentially expert assistance

Conclusion

AI-powered lead generation represents a fundamental shift in how insurance agents approach client acquisition. By leveraging Meta's sophisticated prediction capabilities and establishing robust feedback loops through the Conversion API, agents can move beyond the limitations of traditional lead vendors. This approach delivers higher-quality prospects, reduces acquisition costs, and creates a self-improving system that becomes more effective over time. While implementation requires initial investment and technical understanding, the long-term benefits of targeted, data-driven lead generation far outweigh these initial challenges. As the insurance industry continues evolving, embracing AI technologies will separate successful agents from those struggling with outdated methods. The future of insurance sales belongs to those who harness artificial intelligence to build sustainable, efficient prospect pipelines.

Frequently Asked Questions

How can AI improve lead generation for insurance agents?

AI enhances insurance lead generation by analyzing user data to identify prospects most likely to convert. It continuously learns from conversion patterns, refining targeting to focus on individuals with specific demographics, financial behaviors, and insurance needs that match your ideal client profile.

What is the Conversion API and why is it important?

The Conversion API enables direct data transfer between your systems and Facebook's AI, providing crucial feedback about which leads converted into clients. This feedback loop trains the AI to identify similar high-quality prospects, continuously improving lead quality over time.

How does Facebook AI compare to traditional lead methods?

Unlike traditional vendors selling generic leads to multiple agents, Facebook AI uses precise targeting based on thousands of data points. It focuses on quality over quantity, reduces competition, and improves through machine learning, delivering better-converting prospects at lower costs.

How does AI targeting reduce insurance lead costs?

AI targeting focuses on high-potential prospects, reducing wasted ad spend on unqualified leads and improving conversion rates, which lowers overall acquisition costs for insurance agents.

What technical skills are needed for AI lead generation?

Basic understanding of digital marketing platforms, Facebook Ads Manager, and Conversion API setup is beneficial, but many tools offer user-friendly interfaces that minimize technical requirements for insurance professionals.

Relevant AI & Tech Trends articles

Stay up-to-date with the latest insights, tools, and innovations shaping the future of AI and technology.

Grok AI: Free Unlimited Video Generation from Text & Images | 2024 Guide

Grok AI offers free unlimited video generation from text and images, making professional video creation accessible to everyone without editing skills.

Grok 4 Fast Janitor AI Setup: Complete Unfiltered Roleplay Guide

Step-by-step guide to configuring Grok 4 Fast on Janitor AI for unrestricted roleplay, including API setup, privacy settings, and optimization tips

Top 3 Free AI Coding Extensions for VS Code 2025 - Boost Productivity

Discover the best free AI coding agent extensions for Visual Studio Code in 2025, including Gemini Code Assist, Tabnine, and Cline, to enhance your