Annotation

- Introduction

- Key Benefits of Automated Invoice Processing

- Understanding Human-in-the-Loop Automation Strategy

- Comprehensive Invoice Automation Workflow Overview

- Building Your n8n Automation: Step-by-Step Implementation

- Pros and Cons

- Implementation Best Practices

- Conclusion

- Frequently Asked Questions

n8n Invoice Automation Guide: Human-in-the-Loop Processing

Step-by-step guide to automating invoice processing with n8n using human-in-the-loop verification for accurate financial operations and workflow

Introduction

Manual invoice processing drains valuable time and introduces costly errors into your financial operations. This comprehensive guide demonstrates how to implement intelligent invoice automation using n8n's workflow platform while maintaining human oversight through a strategic human-in-the-loop approach. You'll learn to build a robust system that handles multiple document formats, extracts critical data automatically, and incorporates human verification for accuracy assurance.

Key Benefits of Automated Invoice Processing

Transitioning from manual to automated invoice handling delivers substantial operational improvements. Businesses typically reduce processing time by 70-80% while eliminating common data entry mistakes that lead to payment disputes and accounting discrepancies. Automated systems provide real-time visibility into your accounts payable status, enabling better cash flow management and strategic financial planning. The integration of workflow automation tools transforms what was once a tedious administrative task into a streamlined, error-resistant process.

Understanding Human-in-the-Loop Automation Strategy

The human-in-the-loop approach represents the optimal balance between full automation and necessary human oversight. This methodology automates repetitive, rule-based tasks while reserving human judgment for complex decisions, exception handling, and quality assurance. For invoice processing, this means the system extracts and processes standard data automatically, but flags unusual amounts, unfamiliar vendors, or unclear documents for human review. This hybrid approach ensures both efficiency and accuracy, making it particularly valuable for businesses transitioning from manual processes.

Comprehensive Invoice Automation Workflow Overview

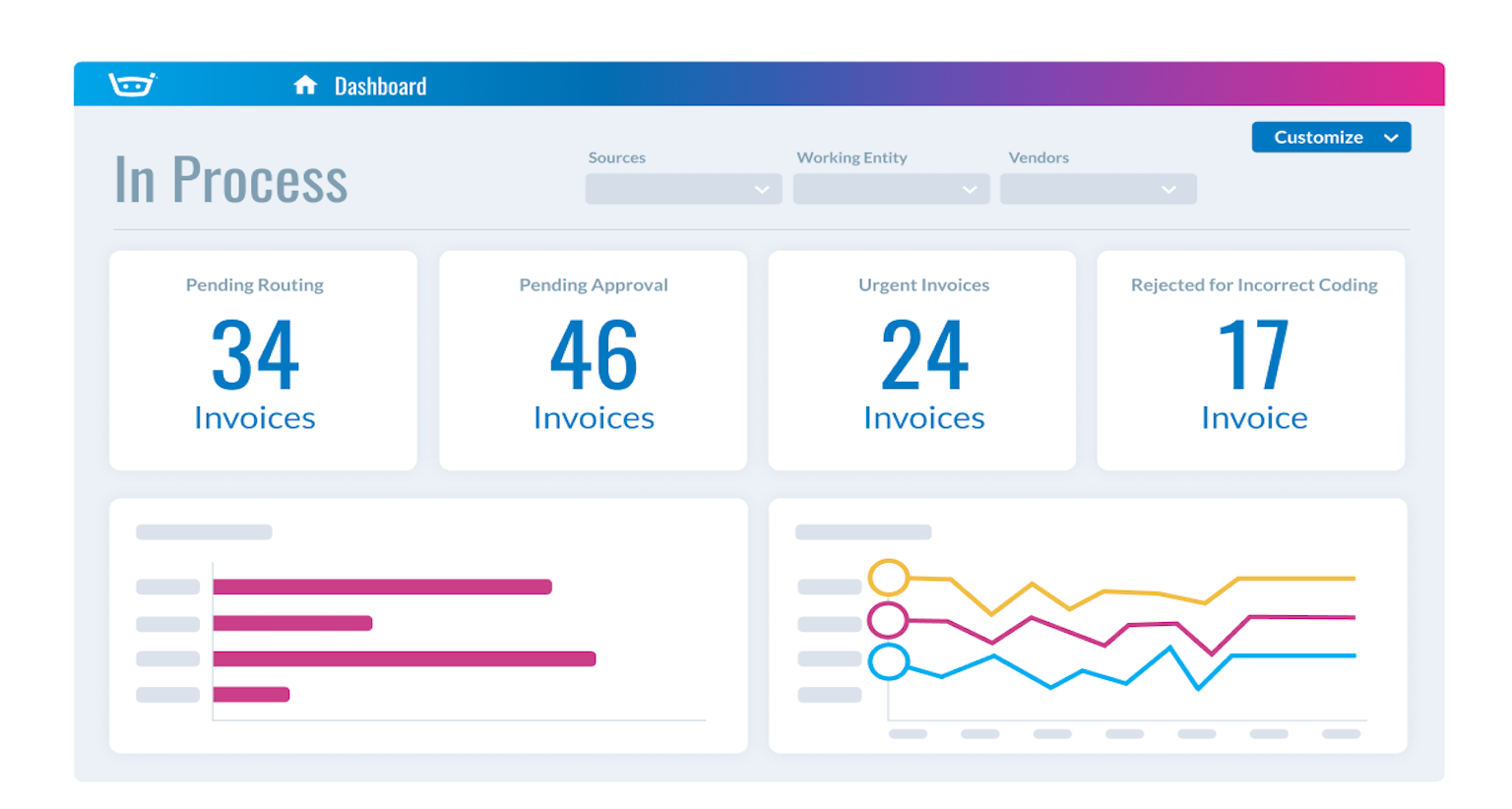

A well-designed invoice automation system follows a structured sequence of operations. The process begins with document ingestion, where invoices arrive through various channels including email attachments, messaging platforms, or direct uploads. Next, intelligent parsing technology extracts key data fields such as invoice numbers, dates, vendor information, line items, and totals. The system then routes this extracted information through validation checks before presenting it for human approval when necessary. Approved invoices proceed to data storage and accounting system integration, while rejected items trigger correction workflows or escalation procedures.

Building Your n8n Automation: Step-by-Step Implementation

Configuring the Telegram Trigger for Document Input

The Telegram trigger serves as your workflow's entry point, listening for incoming messages containing invoice documents. This setup provides flexibility for mobile invoice submission while maintaining security through Telegram's encrypted messaging platform. Configuration involves creating a Telegram bot through BotFather, obtaining the API token, and connecting it to your n8n instance. The trigger monitors for specific message types including documents, photos, and text, ensuring comprehensive coverage for various invoice formats your business might receive.

Implementing the Switch Node for Format Handling

The Switch node acts as your workflow's intelligent router, directing different document types to appropriate processing paths. This critical component examines incoming file properties and routes them based on MIME types and content characteristics. For comprehensive invoice processing, configure separate routes for PDF documents, image files (JPEG, PNG), and text-based invoices. Each route can apply format-specific processing logic, ensuring optimal extraction results regardless of the original document format. This approach demonstrates the power of business process automation in handling diverse input scenarios.

Data Preparation with Edit Fields and Telegram Nodes

Following format-based routing, each processing path utilizes Edit Fields nodes to standardize and clean incoming data. This step ensures consistent data structure across different input types, removing inconsistencies that could disrupt downstream processing. Simultaneously, Telegram nodes provide user feedback, confirming document receipt and processing initiation. This communication maintains user engagement while the system works in the background, creating a transparent and responsive automation experience.

Advanced Document Parsing with LlamaParse Integration

LlamaParse brings sophisticated document intelligence to your automation stack, extracting structured data from unstructured invoice documents. The integration involves configuring HTTP request nodes to communicate with LlamaParse's API, handling file uploads, and managing the parsing workflow. Proper setup includes authentication headers, appropriate content type specifications, and error handling for network issues or service limitations. This component represents the cutting edge of AI automation platforms in document processing.

Processing Status Monitoring and Service Management

Robust automation requires diligent monitoring of external service status and resource utilization. Implement status checking loops that periodically query LlamaParse for processing completion while respecting API rate limits. Include conditional logic to handle different status outcomes: successful parsing proceeds to data extraction, errors trigger notification workflows, and pending status activates wait mechanisms to prevent service overload. This careful management ensures reliable operation while maintaining positive relationships with external service providers.

Intelligent Data Structuring with LLM Chains

Large Language Model chains transform raw parsed data into structured, business-ready information. Configure your LLM node with carefully crafted prompts that specify output formats, required fields, and data validation rules. This step converts the semi-structured output from document parsing into consistently formatted invoice records ready for system integration. The flexibility of LLM integration allows customization for specific business requirements, industry standards, or regional formatting variations.

Human Verification Through Google Sheets and Telegram

The human-in-the-loop implementation centers around the verification step, where extracted invoice data receives human approval before proceeding to accounting systems. The workflow writes parsed data to Google Sheets for record-keeping while simultaneously sending a formatted summary through Telegram for user review. This dual approach provides both a permanent audit trail and immediate mobile accessibility. The verification request includes all critical invoice fields with clear presentation, enabling quick and informed decision-making.

Conditional Routing Based on User Feedback

User responses determine the workflow's subsequent path, creating a dynamic automation that adapts to human input. Positive verification triggers data transfer to accounting systems and completion of the processing cycle. Negative responses halt the automation and can trigger various exception handling procedures, from simple notification to comprehensive correction workflows. This conditional routing demonstrates the sophistication possible with modern document processing automation platforms.

Secure Document Archival in Google Drive

Comprehensive invoice automation includes secure document storage for compliance, auditing, and reference purposes. Configure Google Drive integration to store original invoice documents in organized folder structures with consistent naming conventions. Implement access controls and version management to maintain document integrity while ensuring authorized availability. This archival step completes the end-to-end automation while satisfying legal and operational requirements for document retention.

Testing and Optimization Strategies

Thorough testing ensures your automation handles real-world scenarios effectively. Create a diverse test dataset including various invoice formats, quality levels, and exception cases. Monitor workflow performance metrics including processing time, success rates, and human intervention frequency. Use this data to refine parsing accuracy, optimize resource utilization, and identify opportunities for further automation. Regular testing maintains system reliability as your business processes and invoice characteristics evolve over time.

Pros and Cons

Advantages

- Reduces manual data entry by 70-80% saving significant time

- Minimizes human errors in financial data processing

- Provides real-time visibility into accounts payable status

- Accelerates payment cycles improving vendor relationships

- Highly customizable to specific business requirements

- Scalable to handle growing invoice volumes efficiently

- Maintains audit trails for compliance and reporting

Disadvantages

- Initial setup requires technical configuration expertise

- Dependent on external API services and their reliability

- Potential costs for premium n8n plans at higher volumes

- Training period needed for staff adoption and trust

- Ongoing maintenance required for system updates

Implementation Best Practices

Successful automation deployment follows proven implementation methodologies. Begin with a pilot program focusing on a specific invoice category or vendor group to validate the workflow before full-scale deployment. Involve stakeholders from finance, operations, and IT throughout the process to ensure the solution meets all departmental requirements. Document standard operating procedures for exception handling, system maintenance, and staff training. Establish key performance indicators to measure automation effectiveness and identify improvement opportunities. These practices ensure your accounting system integration delivers maximum value.

Conclusion

Implementing n8n-powered invoice automation with human-in-the-loop verification transforms accounts payable from a cost center to a strategic advantage. This approach delivers the efficiency of automation while maintaining the accuracy and judgment of human oversight. The flexible architecture accommodates various document formats, integration requirements, and business processes. As organizations continue embracing digital transformation, intelligent automation solutions like this provide competitive advantages through improved efficiency, enhanced accuracy, and better financial visibility. The combination of n8n's powerful workflow capabilities with strategic human involvement creates a sustainable automation solution that grows with your business needs.

Frequently Asked Questions

Can I use WhatsApp instead of Telegram for invoice submission?

Yes, n8n supports multiple messaging platforms including WhatsApp, Slack, and custom webhooks. The workflow logic remains similar with platform-specific configuration adjustments.

How accurate is the AI document parsing for invoices?

LlamaParse typically achieves 85-95% accuracy on standard invoice formats. The human verification step catches remaining errors, ensuring overall system accuracy near 100%.

What invoice formats does this workflow support?

The system handles PDFs, images (JPEG, PNG), and text-based invoices through separate processing routes in the Switch node configuration.

Can this integrate with QuickBooks or Xero?

Yes, n8n offers native connectors for popular accounting platforms. Additional HTTP request nodes can handle custom API integrations for other systems.

What's the typical setup time for this automation?

Basic implementation takes 2-4 hours. Complex customizations or multiple accounting system integrations may require additional configuration time.

Relevant AI & Tech Trends articles

Stay up-to-date with the latest insights, tools, and innovations shaping the future of AI and technology.

Grok 4 Fast Janitor AI Setup: Complete Unfiltered Roleplay Guide

Step-by-step guide to configuring Grok 4 Fast on Janitor AI for unrestricted roleplay, including API setup, privacy settings, and optimization tips

Grok AI: Free Unlimited Video Generation from Text & Images | 2024 Guide

Grok AI offers free unlimited video generation from text and images, making professional video creation accessible to everyone without editing skills.

Top 3 Free AI Coding Extensions for VS Code 2025 - Boost Productivity

Discover the best free AI coding agent extensions for Visual Studio Code in 2025, including Gemini Code Assist, Tabnine, and Cline, to enhance your